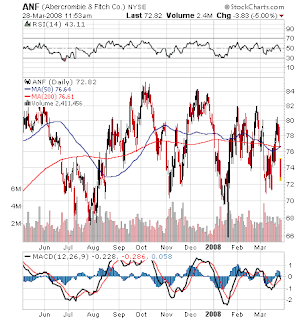

I may be a session or two premature, but I went long Abercrombie (ANF) today as it's now around the low end of it's trading range.

Below is an 11-Month chart that shows the cycles:

The three deepest, major bottoms formed around $68, $70, and $71, but as you can see, minor bottoms have been higher. I may eat a couple dollars of downside if the markets aren't great, but if there's an afternoon rebound today or if we open up Monday, I bet this is where ANF puts in its current low.

With this trade, (if I'm correct about the movement direction), it's usually safe to hold out for $79 or so. It usually tops out a little above $80, but there's a risk of missing the top and having to hold for longer.

The reason I like this trade is that it's pretty predictable, and if something unforeseeable does happen, I'm ok with holding ANF stock for a while.

"I trade with TradeKing: $4.95 stock and options trades, plus lots of tools. It's simply the best way to invest. Click here to find out more.

Friday, March 28, 2008

Going Long ANF - Range-Sound Stock

Labels: ANF, channeling stocks

Thursday, March 27, 2008

Two Public Figures, Lots of Homework, a Little Stock Talk

I apologize for the absence of new posts this week; I've had two exams (well, Macro Econ is tomorrow morning at 10:10) and lots of other work.

Plus, on Wednesday, Jim Cramer came to do his show here. Tonight (Thursday), Bill Clinton came to speak on behalf of his wife.

I semi-reluctantly went to see Cramer put on his show, and I'm glad that I did. I hate the caricature-Cramer of the show, with yelling, screaming, hyperbole, and sound effects - but in real life, I was able to see a different side of him.

And, interestingly, his on-show appearance is turned on and off like a light switch. As the cameras rolled, he was in his TV persona, but as soon as they cut to commercial (when filming here, the "commercial" breaks were about ten minutes long), he began to speak candidly. He fielded long questions and lightning-round quickpicks from investment club and secular audience members; instead of screaming about them, he responded logically and thoroughly. He talked a little about himself and his life, in a very personal and honest way.

So I definitely have a new respect for Jim Cramer. I'm still not a fan of the show, but I like the real Cramer (or at least as much of the real Cramer as I got to know in that hour). He seems like a great guy to have dinner, a beer (if you're of age), or a round of golf with him. One last, possibly jaded comment; if he doesn't like his TV semi-insane alter ego, I feel bad that he has to turn it on for hours every day. However, if it's fun for him... then good for him. He's making money doing it.

Concerning Mr. President William Clinton's appearance tonight...

It was worthwhile to see him, but instead of talking about himself (which I would have cared more about), it was all about his wife and her policies.

I actually registered as a democrat (though I consider myself to be more republican) so I could have a meaningful vote this April in the Pennsylvania primary. Though I'm not a fan of Barack's 20-30% capital gains tax (and main campaign platform of "hope"), I think I'll probably vote for him over Hillary next month. I firmly disagree with many of her policies (as outlined by Bill), except for one - she supports a troop withdrawal, beginning within 60 days of taking office. Iraq is a waste of time, lives, and most importantly, money - money that is spent now, will continue to cost more money later (as veterans require medical care, future aid because of mental illness, etc), and money in the future (in the form of repayment of national debt). It really doesn't matter to me if we're "winning" or if the surge is "working" - great! our generals learned how to fight this war. Just because we're doing better doesn't mean that we should continue to be there. I have friends from high school that went to the Naval Academy, and I hope they'll be deployed in a time of peace.

A couple quick stock thoughts:

I put in a super-lowball bid on a lottery-ticket option for Penn National Gaming (PENN). They are (supposed to be) bought by Fortress (FIG) by the summer, at $67/share. I put in a low bid and got April $55 contracts for $.15 - I'll actually probably sell now that it's a quick double in value. However, if the deal somehow closed between now and then, it would be jackpot for me.

I also tried to short my long-loathed CMG over the past few days, as it's bounced up about $20 for no reason at all... but Ameritrade doesn't have any share available for me to short. Options aren't worth it (premiums are too high), but I'm staying on the lookout for an opportunity to get short.

Financials are coming back down, which I dislike (because I own CFC and ETFC) but also like (because I'd like to buy some LEAP calls of other ones). I think FIG and BX are good buys at these levels; both are about as low as they have ever been, and I think they're likely to snatch up a few good bargains as things have cheapened, which they'll be able to sell for much more when conditions improve. If they fall a little farther, I'm still not against buying FRE or FNM, because I think the quasi-government connection provides safety. Brokers are still dangerous, I think - I'd rather go with a BAC or C, but in a few months after they write down some more of their balance sheet.

Lastly... I'm still in TMA. They'll probably be stagnated between $1-$2 for a while, but it seems like the danger of bankruptcy has passed. If one can endure the 10% daily moves, I think there's an outside chance that its a $5-10 stock in a few years.

"I trade with TradeKing: $4.95 stock and options trades, plus lots of tools. It's simply the best way to invest. Click here to find out more.

Labels: BAC, bill clinton, c, CFC, etfc, fnm, fre, Jim Cramer, TMA

Monday, March 24, 2008

Was that the bottom?

I wrote on March 11th that I had thought we had hit bottom. On March 10th, the S&P established a double-bottom, and the market rallied off of that bottom on the 11th.

One week ago, the market did break through that bottom, as news of Bear Stearn's fire-sale bailout rocked the markets. However, markets recovered from that shock, and actually ended last week positively.

Today, the major indexes are up multiple percent on news of the higher-priced BSC buyout, CIT financing, better-than-expected home sales, and just good feelings. One can almost feel the fear slowly trickling out of the market - and if they don't want to go by feelings, the VIX, often called the "fear indicator" (but actually a measure of options volitility) has fallen from an intra-day high of 35 last Monday to 25 today.

Thankfully, the pathetic-performing financial in my portfolio have begun to pick up some lost ground - Countrywide has moved from $4/share last Monday to over $6 today. (As I love pointing out, Countrywide is in the process of being purchased by Bank of America - at this time, that deal would close at $7.80 based on BAC's share price). I added 30% more CFC at $4.44, and I sold off that block at $6.20 today. I'm holding the rest until the merger close or, at least, the arbitrage gap starts to narrow.

I also bought CIT at $9.90 in the pre-market today as I thought they'd announce good news about financial backing; they didn't even have to announce anything to be up about $3 today. I have an itch to sell now and take my nice daily gain, but I think I'll use my seemingly well-timed entry as a basis for a long-term investment. After all, CIT has fallen from about $60/share, and until recently, its business was not tainted by the subprime fiasco.

I missed out on Freddie and Fannie - I thought were good vehicles to play a housing/economic recovery because of slightly less danger due to their quasi-government status. Both were trading near (or below) $20 last Monday; both are above $30 today.

One of the most interesting aspects about this rally is the depth of companies participating in it. It may be short covering (which I never regard as a bad thing), but many general market laggards are performing, or even outperforming, the overall indexes as they rally. For example, Buffalo Wild Wings, a company that I regard as undervalued, continued to slide and suffer as the markets fell in January, February, and March. However, starting last Tuesday, BWLD reversed the trend, and share price has increased from $20 to $26 in the past four sessions. (Note: The increase is partly due to an analyst upgrade). Crocs and eBay, two more laggards, are both up 15% percent in the last week.

I'm not 100% certain that the market won't face pressure in the coming days, weeks, or months, but the combination of technicals (double bottom, higher lows), data (housing numbers, Fed opening discount window, BSC bailout) and mentality may just mean that the bottom is in.

"I trade with TradeKing: $4.95 stock and options trades, plus lots of tools. It's simply the best way to invest. Click here to find out more."

Wednesday, March 19, 2008

Adding to TMA

I wrote last week about my trading of TMA; I bought a position at $1.35 and sold a third of that position near $3. I decided to let the rest ride this crisis out.

However, today, I couldn't resist putting my hand back in the cookie jar. I bought back the shares I sold at $1.62.

Once again, just like the first time I bought it, TMA has had a huge intra-day fall. Today, it was on news that I thought wasn't bad - it made a deal with its lenders that allows TMA to stop having to sell off its assets.

The deal today did directly dilute shareholder value - it gave the lenders options to buy about a quarter of the company's shares for $.01. But at the same time, it may have allowed TMA to avoid losing even more value, through the sales of its low-risk, quality mortgages at bargain-basement prices. The deal made lenders freeze requests for margin calls for the next year, which should allow TMA to sit on the sidelines and let this crisis play out.

So even if the deal today did reduce shareholder value by 25%, the stock is off more than 40%. I must admit, my appetite for risk is enormous... But I couldn't resist some more TMA.

I trade with TradeKing: $4.95 stock and options trades, plus lots of tools. It's simply the best way to invest. Click here to find out more.

Tuesday, March 18, 2008

Stocks up; Fed Cuts

With more than an hour left in the day, it's hard to tell where the market will go. But major indexes have lost about a percent since the Fed cut the Funds rate by .75% at 2:15.

Thanks to my overweighting (poor diversification?) in broken financial companies, my portfolio is doing well today, so before 2:15 I hedged some of my gains by buying S&P 500 ETF and Countrywide puts. I'd like it if both popped back up and the options expired worthless, but I decide to negate some gains by protecting against losses if today's finish is dismal.

Another thought: I'm not a currency expert, but the dollar is the cheapest it has been in decades, and the Fed looks like it's just about done cutting... I'm starting to look at UUP, a Powershares Bullish Dollar ETF.

"I trade with TradeKing: $4.95 stock and options trades, plus lots of tools. It's simply the best way to invest. Click here to find out more."

Monday, March 17, 2008

Wall Street Values BSC at $90/share

Wait... hold on a second... Didn't Bear Stearns close at less than $5/share today, because of the pending buyout at $2/share?!?

Well, it's true that Bear's market cap at the end of today was $650 million, a horrifyingly low number based on its value of more than $20 billion less than one year ago.

But here's another way to measure the value of Bear Stearns; JPMorgan's price increase today.

JPM shares were up $3.77 today, as the company announced that it was planning to acquire BSC at $2/share. Clearly, investors think that JPM is getting a great deal, as it was one of the only financials to rally on a day when the XLF, the S&P Financial Sector ETF, fell 2%.

So, about that $90/share valuation...

JPMorgan was up $3.77 today, and there are 3.4 billion outstanding shares. Therefore, JPM's market cap increased $12.8 billion today. If you divide that $12.8 billion by Bear's 136 million outstanding shares, the value of JPM's increase translated into Bear shares would price BSC at $94/share.

Now I don't think that BSC is worth $90 per share; there are clearly issues that BSC needs to resolve. However, it does show that investors, whether they are right or wrong, value Bear at much, much more than $2 share.

So what does this mean?

I certainly don't think that the deal will close at $2 share. Today, Bear shares were changing hands at more than twice that much, implying that another party would make a higher offer or that JPM needed to raise its price. The offer does have to be approved by Bear's shareholders, and I think that the 1/3 of shares owned by company employees will lead the vote against the current buyout offer. The Fed did guarantee Bear funding for 28 days, and JPM's new backing of obligations will last a year, as the deal is pending, so Bear's shareholders have some time to think about what to do.

Now, as confidence is restored, the discount window is open, and JPM is insuring obligations, Bear might not need to sell itself at all. As I disclosed before, I own a tiny stake in Bear, and I won't be adding to it at these prices; the uncertainty just isn't worth risking more money. I paid $30 for my shares - thankfully not $50 or $100 or $150 - and I may never see that $30 price again.

Just as many negative factors came together over Long Island, forming the perfect financial storm that capsized Bear's stock, clearing skies, and promise of cheap, available, and guaranteed money may just prove to be a lifeboat for Bear shareholders. Whether it means a buyout at $10, $20, $30, or $50, or the continuation of Bear operating independently, this display of valuation by JPM's investors shows that Bear is worth a lot more than $2/share.

"I trade with TradeKing: $4.95 stock and options trades, plus lots of tools. It's simply the best way to invest. Click here to find out more."

Sunday, March 16, 2008

JPMorgan Plunders Bear Stearns

I was absolutely shocked to see the headline; Bear Stearns bought out at $2 per share.

Prior to the news release, the low estimate of merger-price speculation was at $15/share, a discount of 50% from Friday's closing price. Many analysts expected Bear to fetch more than the $30 closing price from a potential suitor.

I do not understand how Bear's board members sold themselves out for $2/share, or $236 million. The value of their headquarters was estimated to be $12/share by Barron's - why would the board sell out to an offer so far below the value of Bear's tangible assets?

I guess there may be some ghosts on the balance sheet, but I am honestly dumbfounded by the $2 price. I wish I could say I did not own BSC (or was short), but unfortunately, I bought a few share on Friday as I thought that the buyout would be for more than peanuts.

Hopefully another bidder comes along, as it appears as though Bear is a steal at this level. Also, the deal is subject to shareholder approval; considering that employees own an estimated 1/3 of the company, I don't see all of those people losing much of their nest eggs without a fight.

In other news, the Fed also cut the discount window.

As the shockwaves from both events hit investors, futures plummeted. All major indexes are now looking to fall at least 1% tomorrow.

Who wins? It's hard to say. It looks as though shareholders of any US stock will lose tomorrow, and certainly, the evaporation of billions of dollars of BSC will not help millions of investors' portfolios.

As my title suggests, it looks like JPMorgan has stolen itself a building, a clearing house, and many other businesses for far less than the market was valuing them at. Though I'll only get one share of JPMorgan from my BSC, I may look to add more as this may provide very lucrative once cooler heads prevail.

"I trade with TradeKing: $4.95 stock and options trades, plus lots of tools. It's simply the best way to invest. Click here to find out more."

Thursday, March 13, 2008

My Birthday Wish: A Bull Market

Well, I'm 19 years old today... and it's probably the least monumental birthday ever. Other than a few small monetary gifts, it's life as usual. [If anyone is feeling especially generous - stevof@gmail.com is my PayPal account. :)]

So what else is new - oh yeah, the market is tanking.

Thankfully, I sold a third of my Thornberg shares yesterday near $3/share to lock in neutrality for the trade... now, even if the rest of my TMA falls to zero, I'll break even.

I bought some Bear Stearns (BSC) today as a trade, but my lower stop loss was just touched and I was forced out. It has now moved up a couple dollars, so I don't know if I'll get back in (its in my Ameritrade account, where commissions are $10 each way... I should be using my Tradeking account, with $5 commissions). BSC is attractive because it is down like 70% in the past year, but it is clearly having problems operating, so there may be more attractive beaten-up financials.

I also bought some Etrade a few days ago as a speculative play; it's also priced for bankruptcy, while I expect the company to survive and recover.

I also have an order in for American Eagle (AEO) LEAP calls right now - as a teenager (I can only call myself that for another year), I'm familiar with their business. The stock has fallen 50% over the past year, and valuations are at a historic low.

"I trade with TradeKing: $4.95 stock and options trades, plus lots of tools. It's simply the best way to invest. Click here to find out more.

Tuesday, March 11, 2008

Fed Saves the Day; Market Establishes Bottom; Financials Pop

If you're a regular reader, you'll know that I'm more into fundimental analysis than trading on technicals. However, at this point, I'll take any excuse to say that the market is turning around.

After the Fed announced today to accept Mortgage-Backed Securities as collateral on Treasuries (essentially allowing banks to NOT have to sell/write down the MBS while being able to get needed capital), markets exploded upwards. Above is a three-month chart of the S&P 500 ETF.

Looking at the chart, three very important things happened today.

- The RSI touched the "oversold" line (30) yesterday and bounced today, as buyers entered an oversold market.

- Yesterday's close tested the January lows/resistance levels, and the market popped off of those, suggesting strong support at that level. When the market rallied late January, many analysts said that the market had to move sideways and test lows before it could move up for good; after a month and a half of volatile movement, we've retested lows, and apparently, bounced off of them.

- Lastly, on the MACD lower indicator, the gap is closing, and a cross will suggest a bigger change-of-trend.

However, keep in mind that, after a day of 3-4% gains, some sideways or downward action is reasonable, if not necessary. I'd love to see the market up another few percent tomorrow, but such an outstanding day (the best in five years) may prove itself a hard day to follow.

Just a reminder - this weekend I sent out my first edition of the StudentStocksLetter; email me (studentstocks@gmail.com) if you'd like to be added to the email list. Starting this week, I'll also be detailing trades from the previous week.

"I trade with TradeKing: $4.95 stock and options trades, plus lots of tools. It's simply the best way to invest. Click here to find out more.

Labels: bottom, CFC, chart analysis, testing lows, TMA

Thursday, March 6, 2008

Roses or Thorns?

I just took a chance and bought a tiny position in Thornberg Mortagage (TMA). I don't have the time to write a full analysis now, but I think that the company is too good fundimentally to be trading this cheap. One kind of debt is killing them, and it's causing margin calls to completely disable them from operating. But the vast majority of their portfolio is made up of prime and super-prime debt, and I think that, if nothing else, a bigger company will be willing to snatch that up at this price.

Bought in @ $1.35.

"I trade with TradeKing: $4.95 stock and options trades, plus lots of tools. It's simply the best way to invest. Click here to find out more."

Wednesday, March 5, 2008

Investors: Read Before You Vote for Obama

Unless you want to impoverish yourself, consider voting for someone besides Barack Obama.

I'm not going to get too political on this blog (yet), but I felt that there was one bit of information that deserved to be made known at this point:

Obama plans to hike capital gains taxes.

Due to his tax-break initiatives, which aim at lowering taxes for lower-income, middle-income, and elderly taxpayers (which I do not necessarily impose), he plans to raise the capital gains tax to pay for the decreases elsewhere.

How much? It's not clear yet. I can't find an official stated policy on his website, but here are some excerpts I've picked up from other press sources.

The USA Today reports:

"When Obama announced his health care plan in May, his campaign said he could pay for it by rolling back several Bush tax cuts that benefit the wealthy. That included restoring the top rate on investments to pre-Bush levels: 20% for capital gains and 39.6% for dividends.

...However, they could not say how much that would raise or exactly how high Obama would raise them except that the top rate for both would be between 20% and 28% — the rate President Reagan set in 1986.

(source)The New York Times reports:

"While Mr. Obama said he had not settled on how high to raise the capital gains rates, he added that he would “adjust the top dividends and capital gains rate to something closer to — but no greater than — the rates Ronald Reagan set in 1986.” Later, aides said the top rates would be 20 percent to 28 percent. Most people now pay 15 percent on capital gains, with lower-income people eligible for a 5 percent rate."

(source)

So it's not clear exactly how high Obama plans to raise capital gains taxes, but it does seem likely that they will be increased. From what I can tell, based on articles and his website, he does not specify if taxes will be raised for every taxpayer, or if only "wealthy" investors will have an increased burden.

This tax increase will be a terrible blow to the stock market and the fiscal health of America. First, if Barack is elected, the stock market will likely tank, if investors think that a tax increase is probable or imminent. A hike just to 20% represents a 33% increase - a HUGE number - while a raise to the highest stated possibility, 28%, is a 90% increase.

The markets sell off on news lesof their value os scary than that. How eager to would you be to hold onto gains that would lose up to a quarter overnight?

Plus, at a time when most Americans have little net worth, why does it make sense to make it less desirable to save money? The government should be doing everything it can to promote investing and savings; instead of sending rebate checks this summer, they could be sending everyone some stock certificates with C, MBI, ABK, CFC, or BAC printed on them. (That wasn't a wholly serious statement, but it would be much better for the stock market and the American economy for families to spend their $1,000 checks on stocks instead of iPhones.)

Of course, many people aren't in a position to have the capital gains tax really effect their lifestyle; to them, the tax cuts Obama proposes would probably put more money into their checking account. However, everyone from the 50-year-old couple saving for retirement to multi-million-dollar investors should be wary of this possible disaster.

Obama enjoys romanticizing people with words like hope, change, and believe... I think that his focus on lofty ideas has removed him from reality.

"I trade with TradeKing: $4.95 stock and options trades, plus lots of tools. It's simply the best way to invest. Click here to find out more."

Labels: election 2008, obama, taxes

Tuesday, March 4, 2008

Introducing the StudentStocksLetter

I'm going to start writing a weekly letter, uncleverly called the StudentStocksLetter (SSL), that I will gladly email for free to any willing reader.

Simply click to email me, and I'll add you to the mailing list. I won't spam or sell or anything like that; I'll just deliver (great) investing ideas once a week, into your inbox.

As of now, I plan to email the letters every weekend, recapping the previous week and presenting analysis or trading ideas for the coming week.

If the link above doesn't work, just send me an email at studentstocks@gmail.com and I'll put you on the list. Look for the first email this weekend.

"I trade with TradeKing: $4.95 stock and options trades, plus lots of tools. It's simply the best way to invest. Click here to find out more."

Labels: SSL

Monday, March 3, 2008

Commodities Bubble Needs to Burst

....and the government can help this process.

The only good long investment in this current market is an investment in a commodity. Take your pick out of the bunch; whether mined, grown, or pumped, the price is skyrocketing.

I'm not sure that I have earned the credibility to call out professional analysts, but I can't believe that anyone who is still pumping commodities is a prudent investor. Below is the chart of wheat; I think it exemplifies how the current prices can't be justified as a normal movement. Not too many tangible goods can increase in price fourfold in three years (or double in one). However, any agricultural product (or byproduct) has done this recently; corn, soybeans, soy oil, and other products have doubled or tripled in this same time frame.

Not too many tangible goods can increase in price fourfold in three years (or double in one). However, any agricultural product (or byproduct) has done this recently; corn, soybeans, soy oil, and other products have doubled or tripled in this same time frame.

Precious metals aren't too different; gold is setting new (non-inflation-adjusted) highs, while silver and platinum have enjoyed similar run-ups. Oil is also at historic highs, which is in turn increasing prices of natural gas, heating oil, and gasoline. Coal, the one non-renewable resource with hundreds of years of proven reserves, has also ballooned in price recently.

I can discern a few reasons for these increases:

- Devaluation of the dollar

- Mass-exodus from US equities

- The ethanol hoax

- Speculation

The stock market performance is also leading to a search for alternative investments; many people think commodities are the answer. The only stocks currently performing are commodity stocks, as the underlying prices rise themselves.

The promotion of ethanol as a next-generation, better-than-oil fuel is a massive policy blunder. OK, it's a great PR opportunity to take a picture next to a pitchfork-holding farmer in the heartland; however, the same farmer will be cursing that politician in a decade when we're importing grain from Brazil. Someone made a great quote to this affect - "something is surely wrong with society when we burn our food as fuel." As the cost of dinner is increasing, how can anyone support the massive subsidies that allow a negligible amount of ethanol to enter the US energy system? I think if ethanol subsidies ended tomorrow, sure, some plants may shut down, and a few companies may go bust, but corn would return to a normal price, simultaneously decreasing inflation.

Lastly, speculation is clearly responsible for a big part of price appreciation. These people will get killed when the inevitable bust happens.

I'm not betting on an immediate burst; the analysts talking about support for oil at $100/barrel and $1500 gold have succeeded in establishing an acceptance of high prices. But eventually, rationality will return, and people shorting commodities (or stocks/ETFs) will be the winners.

I'm long DUG (Ultrashort Oil & Gas) right now; the energy price swings are a little more short-term than the grains and metals. It's a small position, because it's not worth it to bet against the fear, speculation, and madness driving prices. If key policy (Fed, ethanol, etc) is changed, prices could change soon - otherwise, prices may stay high in the immediate... but wheat won't be above $10 forever.

"I trade with TradeKing: $4.95 stock and options trades, plus lots of tools. It's simply the best way to invest. Click here to find out more."